Welcome to the Elders Insights' Weekly Market Summary for the week 21 to 27 July 2025. We recap what’s happened on the Australian commodity markets over the past week and influencing factors.

Weather

Australian cropping areas received 15 to 50mm of rain in the past week, with the best falls across the southern and northern eastern cropping belt. Falls were patchy in places. Another similar but lighter system is forecast for the next eight days. Some agents we spoke to this morning through Queensland and NSW said falls of 20mm seem like they have had the same impact as much heavier falls.

Across the south-east, in drought affected areas, the rain will boost crop prospects and at least get crops going enough for crop cover. Parts of South Australia’s upper north and Riverlands, the Victorian Mallee and NSW far south-west are the areas most in need of follow-up. The rain is providing much needed subsoil moisture for livestock areas that are now waiting for some longer days to promote pasture growth. It’s probably at least a month away for South Australia and Victoria.

Get weather forecasts for your region on Elders Weather.

Australian Dollar

The Australian $ is stuck in a very narrow range around 65.7USc as financial markets assess the impact of trade deals apparently struck by the US with Japan, EU, Indonesia, Philippines and Vietnam. Those countries look likely to face blanket tariffs of around 15 per cent, rather than the much higher rates mooted on Liberation Day on 2 April.

Livestock

Cattle markets: Most livestock markets were firmer last week with cows leading the charge, topping $4.16/kg lw at Dubbo saleyards last week. The rain will impact available numbers this week and force processors to become more competitive on available supplies. Southern processor activity in Queensland is helping to keep Queensland processors honest and we should see direct to work quotes continue to grind higher this week. Best demand is for HGP free cattle which signals that some of the lift in demand is coming from China importers to replace US beef. The US cattle herd fell to 94.2 million head as of 1 July, a record low for that date, according to the USDA. The herd size was down about 1 per cent from 1 July 2023, which was the last time that the USDA issued data for that date.

Sheepmeat markets: Lamb direct to works quotes of $11.50-11.80c/kg cw set new records last week. Agents see September being very challenging for processors, as the old lambs are running out, but the suckers are not coming on quickly enough. Any decent kill suckers are being sold to the kill now, so they are out of the system. New season lamb average weights are well below a normal season so the supply end is delayed. Many of these will go into feedlots to accelerate outturn, however, lower joinings and marketing rates will likely see supply challenges prevail throughout much of the next season. There are still some major processors that have scheduled annual maintenance due, and all have suggested when supply gets to its lowest point, they will pull that card. Also, there will be a point of consumer resistance to higher lamb prices where local and export market demand will be affected by higher retail prices.

Spotlight on: Lamb prices

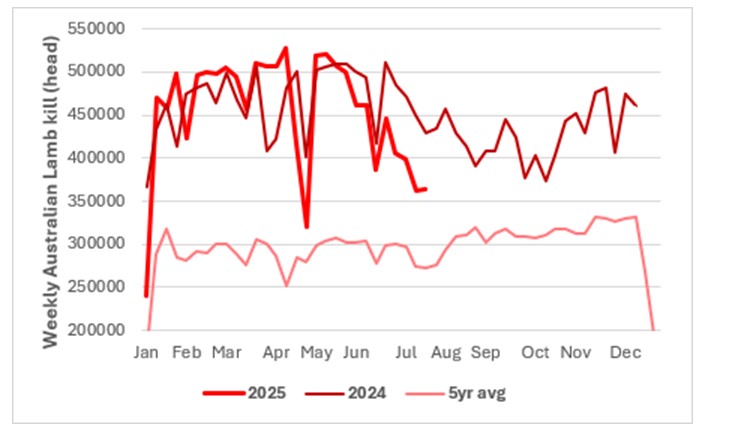

The chart below illustrates the reason why we have seen record lamb price levels with supplies falling well below year ago levels in the past two months. The outlook moving further ahead showing no signs of improving, with August/September supplies looking particularly challenging. With grain prices falling and high lamb prices, producers have plenty of incentive to accelerate weight gains through supplementary feeding which should help lift lamb weights. Reports out of Victoria however suggest low marketing rates - well below 100per cent which will limit available supplies. Eastern states processors are actively trying to source spring store lambs from Western Australia at $4.50/kg lw but are getting little interest with improved seasonal conditions in WA. Over 1 million lambs were trucked across the Nullarbor last year to help alleviate supply shortages on the east coast.

Processors will be doing their calculations about breakeven costs and judging how consumer demand will react to higher prices. Expect some sheep processors to wind back kills over the next few months to reduce demand in order to stabilise prices.

This chart shows weekly national lamb slaughter during 2024, 2025 and 5-year average. Source: MLA

This chart shows weekly national lamb slaughter during 2024, 2025 and 5-year average. Source: MLA

For more insights, refer to our latest cattle market update.

View livestock for sale and our sales calendar listings.

Grain

Global wheat prices slipped under pressure from the advancing northern hemisphere harvest despite solid US wheat exports. Corn fell on mild weather forecasts for the US mid-west. While soybeans continue to struggle against solid crop conditions in the face of weak US export demand. Prices are just hanging on waiting for the rush of Russian new crop sales and for the global corn crop to be made. At this stage it looks as though global grain supplies for the next year will be comfortable and higher carryout stock levels will continue to exert downward pressure on prices.

Local grain markets were under pressure by the end of last week on widespread rainfall forecasts. Old crop markets shed $3-5/t and new crop markets were down by $5-10/t across all major feeding zones, squeezing out some of the domestic premium. Track markets are some $10-20/t lower than delivered and have been quietly drifting lower in line with international values.

Reuters is reporting that Australia is close to finalizing an agreement that will reopen the Chinese market to canola shipments. The world’s second-largest canola exporter has been shut out of the largest import market since 2020 due to phytosanitary requirements aimed at preventing the spread of blackleg disease. According to Reuters, China is allowing Australian exporters to ship five trial canola cargoes. The shipments would carry between 150,000 and 200,000t of Australian canola.

Trade your grain at your price on the secure GCX platform.

Wool

In what was the final sale series before a three-week hiatus, there were broad-based gains in wool prices across the offering with all industry buying sectors active and heavily involved. This week’s action was mainly a case of the big operators winning out for the majority of bales sold. The largest three Chinese top makers and the leading two local trading exporters competed strongly all week pushing the indicator up 18Ac/kg to 1239Ac/kg. Improved buying could signal some renewed confidence in the global economy and a China/US trade deal or could be the result of processors ensuring enough supply until auctions resume.

Learn the many ways we support wool growers.

Sugar

Sugar prices have been under pressure this week due to speculation that India may boost its sugar exports. Sugar prices fell to three-week lows on news that India may permit local sugar mills to export sugar in the next season, which starts in October, as abundant monsoon rains may produce a bumper sugar crop. The outlook for higher sugar production in Brazil is bearish for sugar prices. Datagro said Monday that dry weather in Brazil has encouraged the country's sugar mills to increase their cane crushing, diverting more of the cane crush toward more profitable sugar production rather than ethanol.

The information contained in this article is given for the purpose of providing general information only, and while Elders has exercised reasonable care, skill and diligence in its preparation, many factors (including environmental and seasonal) can impact its accuracy and currency. Accordingly, the information should not be relied upon under any circumstances and Elders assumes no liability for any loss consequently suffered. If you would like to speak to someone for tailored advice relating to any of the matters referred to in this article, please contact Elders.